#mortgage-backed securities

#mortgage-backed securities

[ follow ]

Real estate

fromFortune

3 weeks agoTrump's housing market plan contains a fatal flaw and multiple obstacles, Morgan Stanley says | Fortune

Administration MBS purchases and policy moves will modestly ease affordability but likely won't revive the housing market due to widespread low-rate mortgage lock-in.

fromwww.housingwire.com

1 month agoDecember jobs data continues to support lower mortgage rates

Jobs Friday came and went without much reaction in bond yields because the labor market isn't breaking, nor is it getting stronger. Mortgage rates dropped into the 5s for a short time on Friday as a result of Trump's earlier announcement directing the GSEs to buy $200 billion in mortgage backed securities. The 10-year yield didn't move much after the report.

Real estate

fromwww.housingwire.com

1 month agoTrump directs GSEs to buy $200B in mortgage bonds to lower rates

Combined holdings at Fannie Mae and Freddie Mac grew at a 77% annualized pace over the six months ending in November 2025, rising by more than $68 billion to approximately $247 billion. There remains room for further expansion. Under the Preferred Stock Purchase Agreement (PSPA), each GSE's retained portfolio is capped at $250 billion, with an additional $225 billion limit imposed by the Federal Housing Finance Agency (FHFA) under a prior director.

US politics

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

2 months agoPortable Mortgages Could Help More People Move - But Won't Fix Housing Affordability

Portable mortgages let homeowners transfer existing loan rate, balance, and term to a new home, improving mobility but risking market disruption and unequal benefits.

fromwww.housingwire.com

2 months agoIs the portable mortgage a dream solution or industry time bomb?

He stressed that the U.S. mortgage-backed securities market relies on long-term, fixed-rate loans with highly predictable performance, something portability threatens to destabilize. Portable mortgages, in addition to other issues, would totally destroy the pricing models current used by MBS's in their investor presentations, Cantrell said. The portable mortgage is also predicated on widespread lender adoption and the lender being willing to trade one asset for another.

Real estate

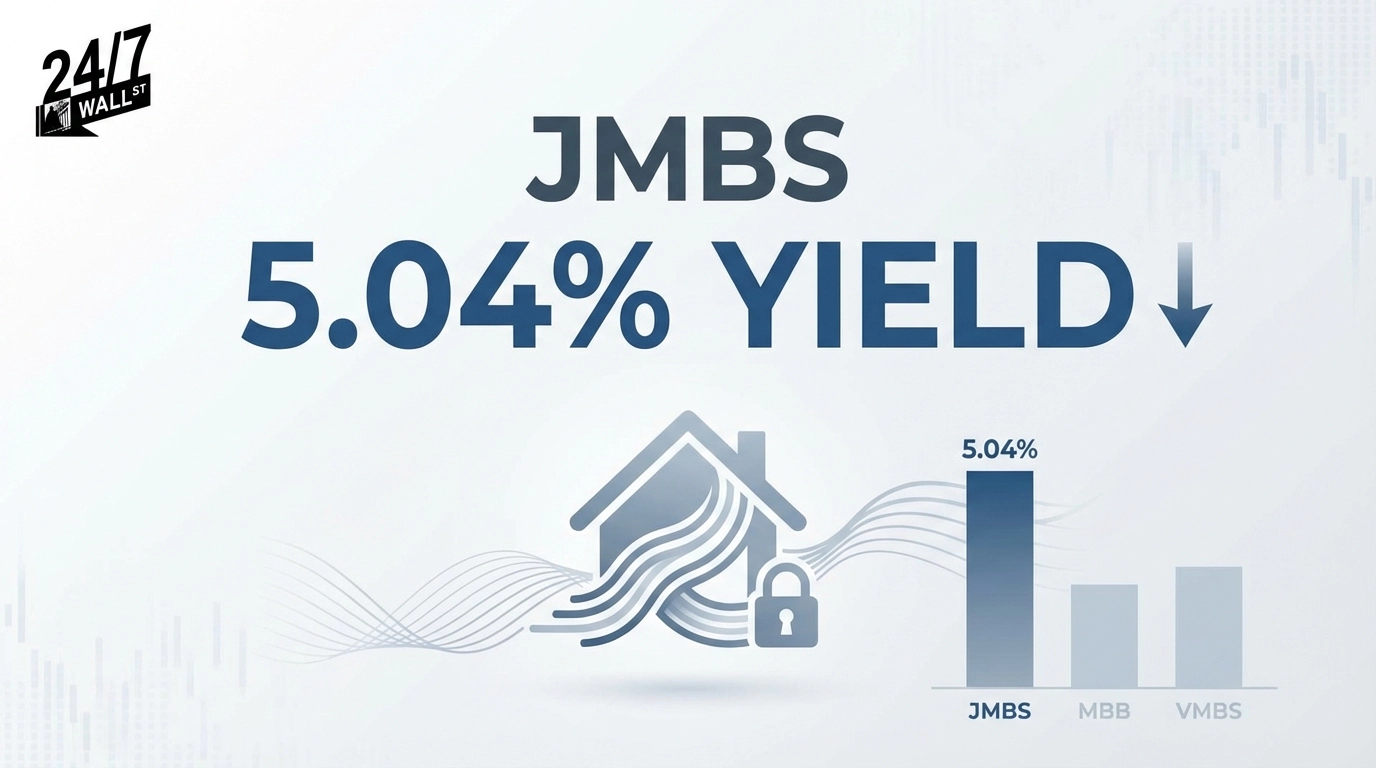

from24/7 Wall St.

5 months ago5 REITs Paying Jaw-Dropping 10%+ Yields And Pay Cash Monthly

"Because of the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses. REITs' dividends are substantial because they are required to distribute at least 90% of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties," says REIT.com.

Real estate

[ Load more ]